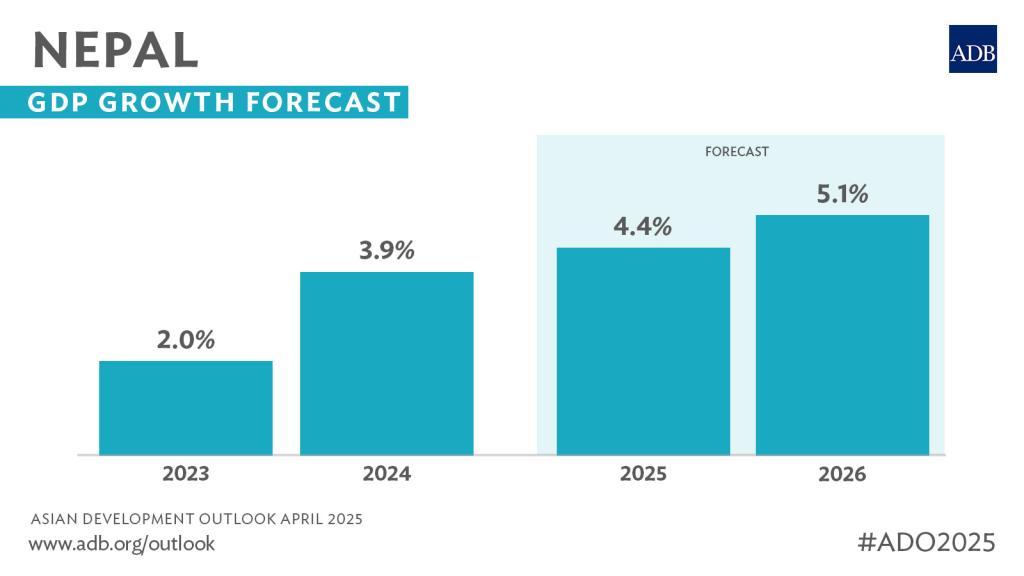

Kathmandu: The Asian Development Bank (ADB) has forecasted that Nepal’s economic growth will rise from 4.4% in the current fiscal year (FY) 2025 to 5.1% by FY2026. The projections were released in the Asian Development Outlook (ADO) April 2025, ADB’s flagship economic publication.

According to the ADO, Nepal’s economy is expected to grow by 4.4% in FY2025, up from an estimated 3.9% in FY2024. Growth in FY2026 is anticipated to reach 5.1%, supported by government reforms aimed at improving capital budget execution, growth in tourism and related services, and increased agricultural productivity through mechanization and better irrigation systems—provided there is a favorable monsoon.

Inflation is expected to moderate in both FY2025 and FY2026, remaining within the central bank’s ceiling. This projection assumes a normal harvest and a modest decline in inflation in India, Nepal’s major trading partner.

“Nepal’s improved growth forecast is being spurred by a gradual recovery in domestic demand, ongoing private sector reforms, and the further revitalization of tourism,” said Arnaud Cauchois, ADB Country Director for Nepal. “Key economic sectors like manufacturing and construction—which contracted in FY2024—are expected to expand this fiscal year due to stable oil and raw material prices, increased liquidity, and declining interest rates, which have boosted credit to all production sectors.”

Nepal’s external sector saw increased stability in FY2024, supported by higher foreign exchange reserves and a prudent monetary stance. Although imports are expected to rise in the latter half of FY2025, strong remittance inflows are projected to keep the current account surplus at 0.1% of GDP. However, in FY2026, a current account deficit of 2.4% of GDP is anticipated, due to increased imports of goods and services.

Nepal’s external sector saw increased stability in FY2024, supported by higher foreign exchange reserves and a prudent monetary stance. Although imports are expected to rise in the latter half of FY2025, strong remittance inflows are projected to keep the current account surplus at 0.1% of GDP. However, in FY2026, a current account deficit of 2.4% of GDP is anticipated, due to increased imports of goods and services.

Risks to the outlook remain tilted to the downside. Rising global tariffs could lead to an economic slowdown, impacting Nepal’s tourism receipts and remittances. Lower foreign aid—on which Nepal depends for development financing—could also negatively affect growth. In addition, under-execution of the capital budget remains a persistent risk to economic performance.

The growth projections were finalized before the 2 April announcement of new tariffs by the US administration. While the baseline forecast only incorporates previously existing tariffs, the ADO includes a detailed analysis of how rising tariffs could affect growth across Asia and the Pacific.