Energy Update

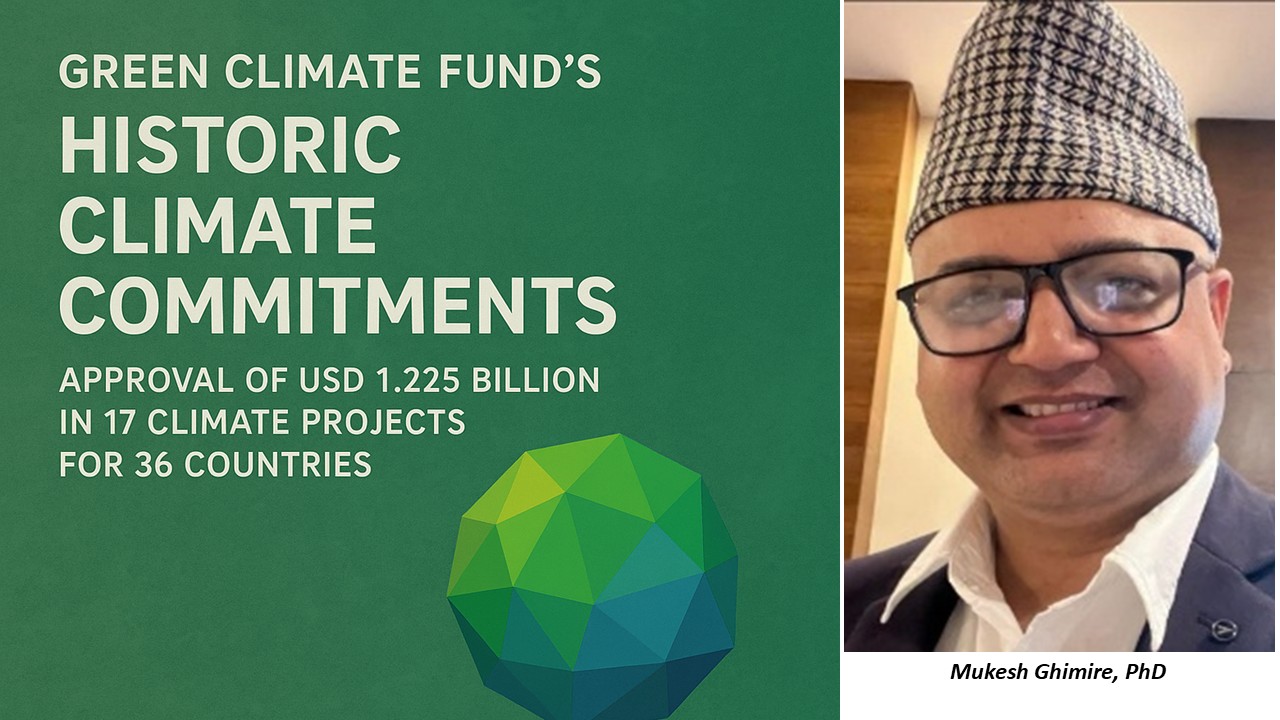

Green Climate Fund Commits $1.2B for 17 New Climate Projects in 36 Countries

In a historic move, the Green Climate Fund (GCF) approved USD 1.225 billion for 17 new climate projects during its recent 42nd Board Meeting (B.42) in Papua New Guinea (30th June to 3rd July 2025) —marking the largest single funding round in the Fund’s history. The decision significantly advances GCF’s mandate to support low-emission and climate-resilient development in the world’s most vulnerable regions.

The newly endorsed projects span 36 developing countries, many of which are Least Developed Countries (LDCs), Small Island Developing States (SIDS), and African nations. These initiatives cover a broad range of mitigation and adaptation activities, addressing critical issues such as glacial melting, extreme weather impacts, agricultural resilience, coastal degradation, and health-related climate risks. This round of approvals brings the GCF’s total project portfolio to 314, representing USD 18 billion in direct funding and over USD 67 billion in total investments, including co-financing. The scale of this investment is not only record-breaking but urgently needed in a global context where climate-related disasters are intensifying in frequency and severity.

Ground Impact: What the Projects Will Deliver

The 17 approved funding proposals underscore GCF’s commitment to both climate mitigation and adaptation, with several projects directly targeting frontline climate impacts in vulnerable regions.

Nepal’s 5th GCF Project: One of the most notable approvals is a project for Nepal, the Green Climate Fund approved FP272: “Protecting livelihoods and assets at risk from Glacial Lake Outburst Floods (GLOFs) and climate change–induced flooding in glacial river basins of Nepal.” This is the 5th GCF project approved for Nepal including other GCF supported projects for AEPC, FAO, IUCN, and ADB (including multi-country project).

For enhancing resilience due to accelerated glacial melts, this newly approved Category B adaptation project will directly safeguard 385,956 people (and indirectly benefit 1,986,980) by combining physical lake lowering, ecosystem-based downstream mitigation, and early warning systems. The $36.2 million GCF grant is complemented by $13.8 million in co-financing, aiming to build technical capacity, integrate hazard data into planning, and reduce GLOF and flash flood risks to communities, infrastructure, and ecosystems in vulnerable Himalayan regions.

The project will be implemented by the United Nations Development Program (UNDP) as accredited entity in collaboration with Ministry of Energy, Water Resources and Irrigation particularly Department of Hydrology and Meteorology as implementing entity, will enhance community-based risk reduction and improve local capacity to respond to climate threats in mountainous ecosystems.

In Saint Lucia, GCF is investing in strengthening the resilience of fisheries—a sector vital for livelihoods and food security. The project focuses on sustainable fisheries management and infrastructure upgrades to reduce the vulnerability of small-scale fishers to climate change. Papua New Guinea, the host of the Board meeting, will benefit from its first-ever GCF-approved project, aiming to boost rural renewable energy access through mini-grids powered by solar and hydropower technologies. This will serve as a model for other Pacific Island countries seeking decentralized, clean energy systems. The Federated States of Micronesia and the Maldives will also see critical adaptation projects: Micronesia’s project addresses climate-related health risks such as vector-borne diseases, while the Maldives will strengthen early warning systems and integrate disaster risk reduction into urban planning.

From a mitigation standpoint, the GCF approved significant projects to mobilize private capital at scale. In India, a USD 200 million project will support a green financing facility designed to catalyze clean energy investments across the country, particularly in underserved regions. A similar market-shaping initiative—the Global Green Bond Initiative—received USD 234.2 million to boost the green bond ecosystem in sub-Saharan Africa, creating pathways for sovereign and corporate issuances that fund sustainable infrastructure.

Other projects focus on climate-smart agriculture, sustainable forest management, water security, and clean mobility across countries like Sierra Leone and Rwanda. These initiatives not only reduce emissions but also build economic resilience and generate green jobs. Importantly, three of the approved projects are single-country efforts in nations receiving GCF support for the first time—Mauritania, Saint Lucia, and Papua New Guinea—highlighting GCF’s push toward broader geographic reach and inclusivity.

Table: Summary of GCF’s newly approved 17 climate projects

| Proposal ID | Project Title | Country/Region | Accredited Entity | GCF Funding (MUSD) |

| SAP050 | Toward Risk-Aware and Climate-resilient communities (TRACT) - Strengthening climate services and impact-based multi-hazard early warning in Maldives | Maldives | UNEP | 25.0 |

| SAP051 | Increasing resilience to the health risks of climate change in the Federated States of Micronesia | Federated States of Micronesia | SPC | 17.9 |

| SAP053 | FISH-ADAPT: Transforming climate resilience and sustainability in Saint Lucia's fisheries communities | Saint Lucia | FAO | 14.8 |

| SAP054 | SOURCE Pacific Drinking Water Project | Pacific Region | ADB | 9.0 |

| FP265 | Climate-resilient landscapes for sustainable livelihoods in northern Ghana | Northern Ghana | UNEP | 63.2 |

| FP266 | Strengthening the resilience of ecosystems and populations in four regional hubs in northern Mauritania | Northern Mauritania | UNEP | 30.9 |

| FP267 | Scaling up ecosystem-based approaches to managing climate-intensified disaster risks in vulnerable regions of South Africa ("Eco-DRR") | South Africa | SANBI | 40.1 |

| FP268 | Scaling-Up Resilience in Africa’s Great Green Wall (SURAGGWA) | Multiple African Countries | FAO | 150.0 |

| FP269 | DaIMA – Dairy Interventions for Mitigation and Adaptation | Multiple East African Countries | IFAD | 150.0 |

| FP270 | Climate Adaptive Irrigation and Sustainable Agriculture for Resilience (CAISAR) in Cambodia | Cambodia | IFAD | 80.0 |

| FP271 | India Green Finance Facility (IGFF) | India | ADB | 200.0 |

| FP272 | Protecting livelihoods and assets at risk from Glacial Lake Outburst Floods (GLOFs) and climate change-induced flooding in glacial river basins of Nepal | Nepal | UNDP | 36.2 |

| FP273 | Papua New Guinea REDD-plus RBP for results period 2014-2016 | Papua New Guinea | FAO | 63.4 |

| FP274 | Building the Climate Resilience of Children and Communities through the Education Sector (BRACE) | Cambodia, South Sudan, Tonga | Save The Children Australia | 40.8 |

| FP275 | Scaling up the Deployment of Integrated Utility Services (IUS) to Support Energy Sector Transformation in the Caribbean (Phase 1) Programme | Caribbean SIDS | CDB | 26.7 |

| FP276 | GCF's investment into the Global Green Bond Initiative (GGBI) (previously known as Green and Resilience Debt Platform (GRDP) | Global: 3 regions; 10 countries | EIB | 234.2 |

| FP277 | ATOME Villeta Green Fertilizer (AVGF) Project | Latin America & Caribbean (Paraguay) | IFC | 50.0 |

Direct Access and Reform

The B.42 meeting was also a turning point in terms of how projects are implemented. A majority of the new projects were developed in partnership with Direct Access Entities (DAEs), which are national or regional organizations accredited to receive GCF funding directly. As an indication of GCF’s determination to rapidly move projects to implementation, project agreements were signed with the Accredited Entities for nine of the newly approved projects immediately after the close of the Board meeting. Additionally, Of the eight newly accredited institutions approved during the meeting, seven were DAEs, further strengthening the Fund’s commitment to local leadership and ownership. GCF now has a total of 153 Accredited Entities, including 101 regional or national entities.

This shift matters. Direct access improves efficiency and relevance by empowering local institutions to design and manage climate solutions based on context-specific needs. It aligns with global calls for climate finance to be more accessible, transparent, and equitable. Many of the approved DAEs, such as the Development Bank of Rwanda and the National Bank of Egypt, will now be better positioned to manage climate finance pipelines and implement green strategies in their home countries. This marks a move away from a donor-driven model toward one where recipient country steer their own climate agenda.

Scaling Ambition and Delivering Impact

While the funding commitments are impressive, GCF has made it clear that this is only the beginning. The Secretariat and Board reaffirmed their commitment to the “50by30” vision—mobilizing USD 50 billion per year by 2030 through a mix of public and private finance.

GCF Executive Director Mafalda Duarte emphasized that such ambition must be matched by reform and efficiency. The Board adopted key changes to the Fund’s accreditation model to shorten approval timelines and boost partner engagement. A new nine-month service standard for accreditation review was introduced, addressing long-standing concerns about delays. The meeting also saw the launch of a global call for expressions of interest to host GCF regional presence offices. By establishing outposts in different continents, GCF aims to enhance technical support, speed up project development, and improve monitoring—particularly for countries with limited institutional capacity. Moreover, updated Staff Regulations were approved to bolster the Fund’s ability to attract top talent and strengthen internal governance. A capable and well-supported Secretariat is crucial for ensuring that approved projects are implemented with high quality and transparency.

A Clear Signal Amid a Warming World

The GCF’s record-breaking approvals send a strong signal at a critical juncture in global climate negotiations. With trust in international climate finance mechanisms still fragile—especially among developing nations—concrete action like this builds confidence and demonstrates that commitments are being honored. What distinguishes this funding round is not only its scale but its strategic focus: empowering vulnerable nations, mobilizing private capital, scaling direct access, and aligning with national development plans. In doing so, the GCF is not only responding to climate threats—it is supporting long-term transformation.

Still, the real measure of success will lie in implementation. Projects must deliver tangible benefits: solar-powered schools in island nations, functioning flood defenses in Himalayan villages, accessible green finance in African cities. GCF and its partners must now ensure that the momentum created at B.42 translates into real-world impact—on time and at scale. As climate challenges mount, this meeting offers a rare example of hope backed by money, structure, and intent. It reminds the world that climate finance, when done right, is not charity nor keeping silent for poor and developing countries by the developed one—it is investment in a livable future for all.

Disclaimer: The author is currently working as Director at the Alternative Energy Promotion Centre (AEPC), Ministry of Energy, Water Resources and Irrigation, Government of Nepal. He is also serving as Project Manager for World Bank supported project and GCF- Secondary Focal Person. The opinions expressed in this article belong solely to the author’s personal views and do not reflect the views of the author’s organization.

Conversation

Mukesh Ghimire, PhD

The author is currently working as Director at the Alternative Energy Promotion Centre (AEPC), Ministry of Energy, Water Resources and Irrigation, Government of Nepal.

- Info. Dept. Reg. No. : 254/073/74

- Telephone : +977-1-5321303

- Email : [email protected]