Energy Update

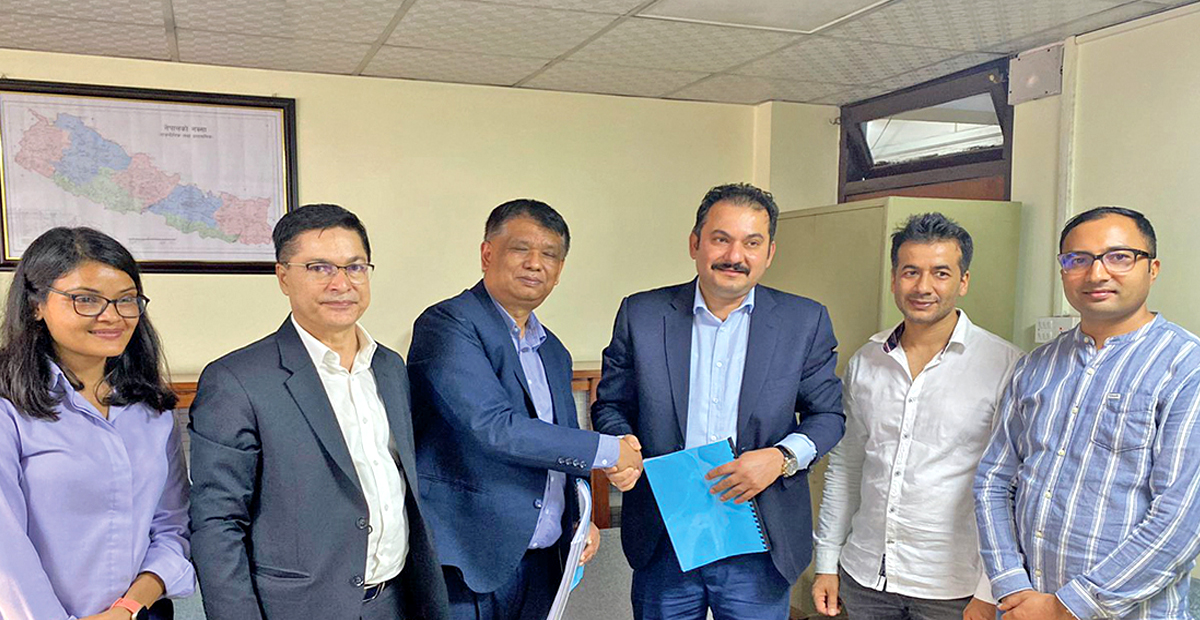

IPPAN and NIA ink an agreement to settle disputes on hydropower insurance premiums

Kathmandu : The Independent Power Producers' Association, Nepal (IPPAN) and the Nepal Insurers' Association (NIA) have signed an agreement to settle disputes related to hydropower insurance premiums.

The officials of the NIA and the IPPAN Secretariat on Wednesday reached a consensus through fruitful deliberations. To ensure a scientific and fair evaluation of insurance premiums, it has been decided to form a committee with three representatives from each side and two expert members. This committee will meticulously assess the appropriate premium rates for hydropower insurance. Both NIA and IPPAN have pledged to honor the recommendations of this committee, regardless of whether they indicate lower or higher premiums compared to the current rates.

During the discussion, Chunki Chhetri, president of the NIA, acknowledged the challenges faced due to the reluctance of reinsurance companies to reinsure Nepali hydropower projects. While expressing support for the development of the energy sector, Chhetri emphasized the need to strike a balance between seeking profit in private sector businesses and ensuring reasonable insurance costs.

The IPPAN President Ganesh Karki emphasized the importance of considering the proportionate risk coverage with any changes in premium rates. He expressed his concerns about insurance companies increasing premiums while potentially reducing the risk coverage, which is detrimental to the industry.

Mohan Kumar Dangi, senior vice-president of the IPPAN, asserted that if the promoters rejected the previous premium, they will not accept a new premium rate and under any circumstances. Uttam Blon Lama, vice-president of the IPPAN, advocated for comprehensive risk coverage, drawing parallels with entire risk insurance for car owners, even in the event of an accident. He also raised concerns about the clarity regarding the minimum or maximum time to receive payment after making a claim, while insurance premiums are being reconsidered.

Ashok Khadka, CEO of Neco Insurance, informed that a proposal to raise the hydropower insurance premium from Rs 2 to Rs 7.50 per thousand has been forwarded to the Nepal Insurance Authority for final approval. To avoid adverse impacts on hydropower promoters, he suggested that the premium could be maintained at Rs 5.50 based on a comprehensive analysis of global premium trends. He proposed establishing a committee to determine the rates, advising the IPPAN to continue with a premium of Rs 2 per thousand until a decision is reached.

In the past, after the insurance committee decided to unilaterally increase the insurance premium, the IPPAN opposed it. When the insurance authority tried to increase the premium a little while ago while rejecting the previous premium, IPPAN also warned not to increase the premium without discussing it with the concerned parties.

Conversation

- Info. Dept. Reg. No. : 254/073/74

- Telephone : +977-1-5321303

- Email : [email protected]