Energy Update

Joint Investments for Sustainable Energy in Nepal

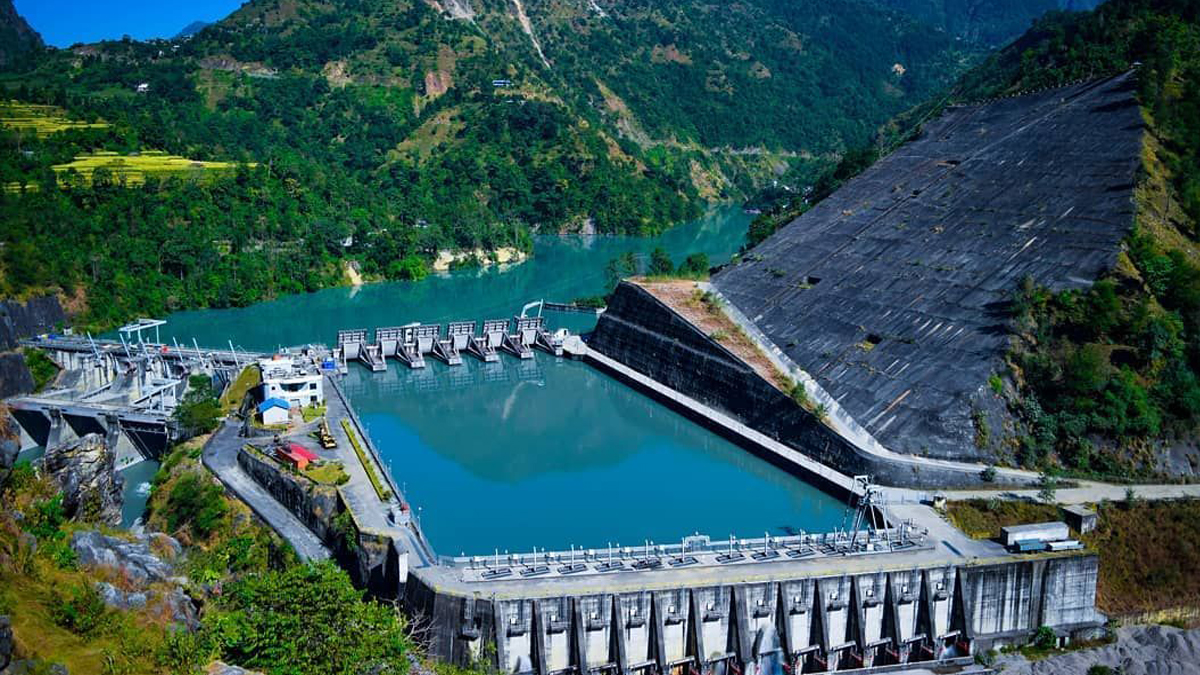

Nepal is blessed with enormous natural water resources that comes by the Himalayan glaciers and countless river sources, the country is regarded one of the most hydrologically rich regions in the global world. Studies recommend that Nepal has a hydropower potentiality of more than 73,000 MW capacities, with around 43,000 MW being technically sound and economically feasible. These capacities, if well-developed could meet Nepal’s domestic electricity demand for decades and also position our country as a major electricity exporter of clean energy to the south Asian markets for India and Bangladesh route. The accessibility of such convenience resource presents Nepal with a imitable opportunities to shift towards sustainable practices for the sustainable energy development that drives economic growth of the country to foster development in all over Nepal that would help the industries to be self-reliable to support the government and to develop the societies that is still below the facilities that is required to jump from the least developed countries title to developing countries that meets the objectives of the country to develop with less dependency with the neighbours.

Despite having this potential, Nepal has so far tapped the electricity below 2 percent as considered studies. The reason behind this slow progress is many, ranging from limited infrastructure and investment to policy hurdles and geopolitical challenges that is often neglected by the government and the private institution either by the incompetency from the Bureaucrats and either to exercise that Nepal is on the equal footing for the contribution of their energy and water resources to the needy ones. The experts from the Nepal shall focus the country first strategy for the development instead focusing on other commands.

We can develop our infrastructures and we can bring investment if we create a strong legal and economic regulatory framework mechanisms to sustain our economic growth and support employment opportunities, industrialization, and social growth. In this regard, the growing demand for the energy resources in form of hydropower, solar and other alternatives sources shall be developed to meet the electricity demand for the supply chains. Nepal is far behind in the development process because of its structural and administrative obstacles.

The lack of consensus for the investment policies through the government and unnecessary burdens for the investors has created chaos for the international investors to invest the financing for the development projects. Another bigger obstacle is the corruption where majority of the people are involved in practising the rent seeking that is a big challenge for Nepal’s economy to sustain. If Nepal can reform its traditional structure and administrative approaches, the hydropower and all the energy sector could thrive and become the backbone of its economy, generating revenue, creating jobs, and driving regional cooperation in clean energy that would not only benefit Nepal but the neighbouring countries as a whole.

To recognize the immense potential to achieve the 73,000 MW, Nepal has to set a target to fulfill its energy demand through various renewable resources, with hydropower as the main focus in comparison to Solar PV, wind, biomass, and green hydrogen. The water resources represent a golden opportunity not only for Nepal’s energy security but also to make the investors invest in such a natural resource to focus on sustainable development that would provide good investment returns. Nepal ministry of energy, investment board, and the other sectorial government shall work as a catalyst to bring the investment to develop high value projects to generate revenue that would help the government of Nepal to focus on the other development that support the economic growth of the country.

To recognize the immense potential to achieve the 73,000 MW, Nepal has to set a target to fulfill its energy demand through various renewable resources, with hydropower as the main focus in comparison to Solar PV, wind, biomass, and green hydrogen. The water resources represent a golden opportunity not only for Nepal’s energy security but also to make the investors invest in such a natural resource to focus on sustainable development that would provide good investment returns. Nepal ministry of energy, investment board, and the other sectorial government shall work as a catalyst to bring the investment to develop high value projects to generate revenue that would help the government of Nepal to focus on the other development that support the economic growth of the country.

Hydropower stands out as the most widely used renewable sources of electricity and is expected to remain the leading renewable energy technology for power generation. Country with favourable geography and ample resources have an exclusive opportunity to harness hydropower for sustainable development, that drives ultimately the economic growth while reducing dependence on fossil fuels that would help to minimize the environmental impact.

To support the view of the article, the one of the major challenges faced by Nepal is attracting the necessary investments either from national or the foreign is to fully realize the potential. Nepal has not utilized its full efforts to collaborate with all international organizations, banks, financing bodies, grants and other tools to focus for the development of the infrastructures and industrialization of the country. The traditional policies that were not reformed as per the requirement is also a hurdle for public and private organization to step forward to secure investments that is required for the development.

To collaborate with all the investors, Nepal shall warmly invite both global powers and regional investors to participate in shaping the country’s overall future but not only the energy and the large-scale projects. The government shall actively promote carefully the planned projects that are designed not only to attract huge investments, but also to make a meaningful contribution to create jobs for the community, to facilitate the social responsibility, stability, timely delivery of the services and overall Nepal’s energy development. The present government and the other relevant authorities like ministry, government offices and the private institutions shall commit on ensuring economic transparency, efficiency, and sustainable growth in all energy initiatives.

The government of Nepal should prioritize and showcase the major energy projects that shall be developed to meet the demand of the country and to export the electricity to manage regional cooperation that would make Nepal into equal footing in the SAARC region and in the global stage for their contribution to the society. If Nepal’s energy would be a reliable source for neighbours, then they shall treat us equally and shall not be barred in the other development side, pressing Nepal to sign on the treaty or any other agreements that oppose the country’s interest.

Our message to potential investors of neighbouring and international communities shall be straightforward. Mismatch policies with hidden interest shall be prohibited. Our history shows that investment was injected, project was delayed due to licensing and other administrative hurdles that affected the development processes. Our motto should focus on long term investment to build Nepal and paying all the remaining debts to the donors or the investors within prescribed period. The capital investment is most necessary to develop the large-scale projects. We need the advancement technology for sustaining our projects. Few mechanisms a government shall step that really helps investment from foreign and domestic investors:

• Nepal must simplify and harmonize laws, regulations, and bureaucratic procedures for investors. Long approval processes and fragmented regulations discourage foreign and domestic investors.

• Encourage PPP models in energy projects to leverage private sector efficiency while maintaining public oversight.

• Develop faster, transparent land acquisition and leasing procedures to facilitate infrastructure and energy projects, reducing delays caused by traditional practices.

• Introduce tax holidays, lower tariffs on imported technology, subsidies for renewable energy, and incentives for setting up manufacturing units to attract large-scale investments.

• Modernize policies to promote hydropower, solar, wind, and biomass energy projects, allowing private and foreign investors to participate with long-term power purchase agreements.

• Introducing innovative river management techniques for hydropower, irrigation, and flood control to attract foreign collaboration in sustainable water projects. Diversify energy sources with solar, wind, and biomass projects, offering investors reliable returns through clear feed-in tariffs and purchase guarantees.

• Enforcing rules and regulations consistently to ensure investor protection, and discourage corruption or any rent seeking by the officials or channels.

• Implementing digital verification and transparent monitoring systems to prevent identity fraud, ensuring trust in national documentation critical for banking and investments. Cross verification and scrutinizing of documents from international credit ratings.

• Streamlining tax codes, reduce unnecessary bureaucracy, introduce clear incentives for investments in priority sectors, and improve tax compliance mechanisms.

• Introduce of digital TDS and VAT enrollment to prevent corruption in terms of fraudulent practices that current big houses and small entrepreneur do in Nepal. Malpractices for asking additional VAT bills from the parties shall be discouraged that demonstrate clear fraud.

• Engaging in targeted partnerships with countries, development banks, and international investors for technology transfer, joint ventures, and capacity building in energy, infrastructure, and industrial sectors and focus in skill transfer technology to be self-reliant.

The country can offer the investors to invest their fund to contribute to the country’s sustainable objectives while benefiting from a swiftly developing market with planned strategies that have positive impact on the society. Our country needs investments that can leverage the technical and financial sources, and technology advancement to drive the economic growth of the country in a key sector like energy.

One of the most challenges areas where the investment can be injected can have the positive impact to the other as well if the investment come through clear policies and programs. Consistent energy supply is quite essential for manufacturing, healthcare, education, other infrastructures like roads, highways, airports, food production, and technology sectors, where the international investment can accelerate these outcomes while ensuring the ESG as well. The good governance presence is required to collaborate with the international investors so that they can feel security in investment program.

There are other infrastructures except energy that Nepal has to collaborate with the international organization like IFC, DFC, ADB, World Bank, FMO, and other government and funding organizations to develop the country in all sectors but not only the specific one. Nepal needs to think and act for the development of highways, rural and urban linkage which are crucial for connecting provinces that would help facilitating trade, and improving connection for the food production and transportation that will encourage farmer to focus on the agriculture that is required for the present and the future generations making the regional markets grow domestically and internationally.

We have airports present for the domestic and international that connects us to utilize our resources. The investment not only fulfil one sector but that would help the other sector in terms of tourism, culture and heritage preservation, transportation sector, education training centre, upgrading university’s structure, border security, and other essential infrastructures that can be developed regionally, creating multiple branches to focus on the economic growth and revenue generation for the public and attracting both domestic and international talent to develop our country.

In addition, Nepal shall need to assure to the investors that they align with international standards, and ensure that development is solely focus for the development of the country. The government and the private developers shall assure to the investors that amount that is injected for one project is not injected in other projects or for any bribes and corruption that can delay the project timeline and cost overruns and affect the project scenarios.

The government and the private sector must align with the international transparency policies that can help the state and local governments generate consistent revenue from such investments that can improve basic public services that a society needs. In my opinion, domestic and international investment in Nepal is not just a financial opportunity, but it is a long-term partnership that can transform the country into a regional hub for energy having the potential to meet the demand of the studies to meet 73,000 MW, a capacity, currently a nation hold that can transform the nation and overall prosperity.

Foreign direct investments that come in the phase of grant, sovereign fund, debt financing, equity financing and other mechanisms that brings not only the capital required for large-scale projects but also advanced technical expertise, global best practices, and operational efficiency, helping projects move forward swiftly while adhering to the national and international standards. To encourage such investment, Nepal shall introduce streamlined regulations, offered incentives for projects in remote areas, and support joint ventures between foreign investors and local developers that can cater the development that we see. The Public Private Partnership model is also the effective model to develop the large-scale energy projects in Nepal. The success of several hydropower initiatives like 456 MW Upper Tamakoshi Hydropower Project, and other private developers demonstrates the value of combining investment with foreign and domestic knowledge. The main advantages of collaborating and partnering with government and local developers who possess a deep understanding of the country’s geography, communities, and regulations, international investors can navigate these challenges efficiently while ensuring the competent projects maintain high standard of safety, environmental care and social responsibility.

Nepal’s traditional processes are often fragmented, opaque, and time-consuming, which limits large-scale investment. By modernizing regulations, improving transparency, incentivizing high-impact sectors, and leveraging public-private partnerships, Nepal can attract investments that drive rapid development across energy, infrastructure, agriculture, healthcare, and technology sectors. The key is predictable, investor-friendly governance combined with strategic capacity-building to make investment not only possible but profitable and sustainable.

The collaborative approach with holistic model can make our portfolio that comprises of various hydropower and solar projects. Our portfolio also comprises of 420 MW, peaking run of river project capacities of secured investment opportunities that is designed to provide with a reliable path to sustainable investment returns. Each project has their own detailed features comprising of detailed project report, field investigations like detailed topographic surveys, geological and geophysical investigations, industry registration, installation of weather record station, water level recorder, discharge measurement, and completion of environmental and social assessments that inform the conditions of the ESG, mitigating risks and maximizing the potential for delivering the tasks successfully.

Being surrounded by two global economically sustained countries, Nepal’s strategic location between India and China positions it as a regional hub, enabling electricity export to neighbouring countries and providing investors with an opportunity to invest with multiple revenue streams. By focusing on regional and provincial development, the government can reduce disparities, stimulate rural economies, and create equitable growth while safeguarding national interests first.

By partnering with us, investors don’t just fund projects, they join a movement that energizes Nepal and empower its people, and strengthen bilateral and multilateral relations that has been faded up due to inconsistency policies, lack of clear investment strategies, and strategic planning. Instead, being single finger, let us together be united, we can turn Nepal’s energy potential into progress, innovation and meaningful impact for investors and the region alike.

Nepal’s energy sector holds immense untapped potential, waiting for visionary investors to unlock it. The time to act is now, invest in Nepal, invest in large scale projects and be part of a transformation that energizes the future, the future of nation, the future of communities, the future of present and future generation, the future for overall development of nation, the future to bring the skilled people in job opportunities, the international technologies to sustain designs, to support local knowledge, to focus on the infrastructure development of nation taking country first interest.

The author is a Principal Engineer whose expertise is in hydropower & Dams, solar and construction projects & contracts and currently working in Nepal energy sector. He is also a recognized professional engineer from Engineers Australia.

References

1. Nepal begins first power exports to Bangladesh via India’s grid

2. Central Bank Policy and Investment in Renewable Energy in Nepal

3. Sustainability Standard: An Overview of Opportunities and Implementation of ESG in Nepal

4. An Analysis of Approved Foreign Direct Investment in Hydropower of Nepal

5. A Gateway to Promote Sustainability and Investment in Nepal

6. Hydropower: Fueling Sustainable Socioeconomic Growth

7. Role of Private Sector in Transformation of the Energy sector in South Asia

8. Hydropower Law in Nepal

9. Nepal, Bhutan seek Indian investment for hydro power projects

10. Energy Consumption for Economic Development in Cooperation in South Asia

11. Can an Investment Summit Boost Nepal's Renewable Energy Investments?

Conversation

- Info. Dept. Reg. No. : 254/073/74

- Telephone : +977-1-5321303

- Email : [email protected]

.jpg)