Energy Update

Killing the rooftop solar

Kathamandu: Nepal was an early adopter of solar rooftop systems. Nepalis were forced to fend for themselves due to erratic supply from the Nepal Electricity Authority (NEA), and they installed solar panels and batteries so they would have energy for their homes and businesses.

They were pleasantly surprised during the Tihar festival in 2016 when the NEA proclaimed the end of the dreaded load-shedding. A country that had suffered 16 hours of rolling blackouts daily for decades was now fully illuminated. Nepalis remember it as the day when the “god of light” NEA Managing Director Kulman Ghising did magic. So, did the end of load-shedding also signal the end of the solar rooftop sector, or was it just the beginning?

There is adequate power now, so solar rooftops are no longer required. But this is a terrific opportunity to promote solar rooftop grid-connected systems (SRGCS). Grid-connected systems allow people to consume solar-generated electricity and export the excess to the grid.

The net metering policy, which enables consumers to interconnect with the NEA grid and export extra power, has proven to be a great policy tool to scale SRGCS. Nepal passed a net metering policy in 2018, and the Ministry of Energy, Water Resources and Irrigation published a net metering directive in 2018. However, net metering did not happen in Nepal.

There are multiple reasons behind this failure, but three reasons stand out. The first reason is the NEA never adopted SRGCS and net metering.

Around hydropower

The core culture at the state-owned utility is developed around hydropower as the main source of electricity. The entry of solar was treated as a threat instead of an opportunity. The NEA never equipped its employees with enough technical and procedural knowledge to take net metering forward. Therefore, solar developers took it upon themselves to educate the NEA staff at various distribution centres on several aspects of net metering. With power being generated in abundance by the existing hydropower plants in recent times, the NEA is further neglecting the need and role of solar use. The importance of an energy mix and several other benefits of solar has been ignored.

Globally, net metering policies are revised to redistribute benefits to consumers and utilities. The state of California in the United States, after 26 years of implementation of net energy metering, revised its policy recently from net metering to net billing. Net metering enables the consumer to set off kWh to kWh against the grid electricity that the customer imports versus the solar electricity that the customer exports. Net billing only allows the customer to offset a certain price per kWh which is always lower than the price of the electricity imported from the grid. California made these changes after it enabled 12 gigawatts of SRGCS capacity across the state. The utility faced huge challenges as SRGCS generated large volumes of electricity during the daytime. Electricity prices and electricity operations were affected adversely. This change came after a huge tussle between solar and utility proponents.

The story is relevant to Nepal. The NEA does not have a single megawatt installed under the net metering mechanism, yet it changed the net metering facility to net billing against the ministry’s policy and the Electricity Regulatory Commission’s directive. The net billing mechanism did not allow net metering SRGCS to flourish as it killed the financial viability of installing such systems. The tariffs offered to customers for exported electricity are 40 percent lower than the tariff charged for NEA electricity. The NEA has proposed to lower the export rate further from Rs7.3 per kWh to Rs5.94 per kWh. This has been proposed due to the change in utility solar rates. Is the NEA really that oblivious to compare a utility-scale solar project to SRGCS?

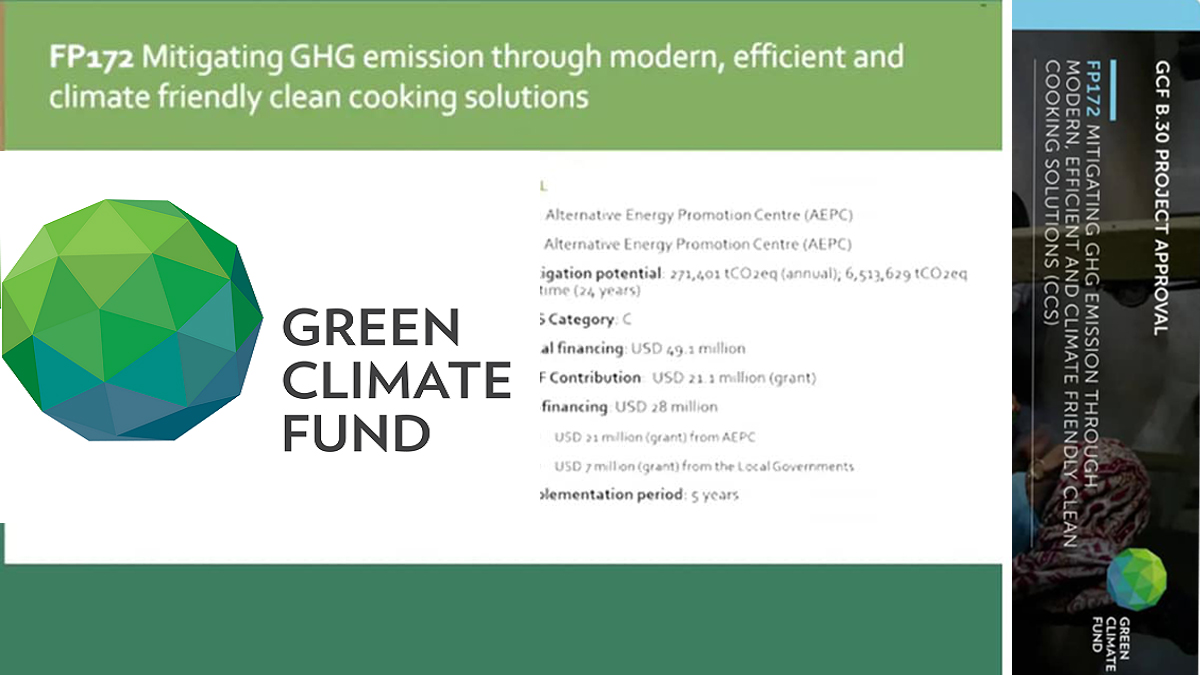

Many stakeholders are involved in SRGCS with net metering sector. Many development partners have conducted studies and published reports on “how viable SRGCS is”. Several subsidy-based programmes are currently being implemented by development partners led by Alternative Energy Promotion Centre (AEPC). The programmes claim to be the catalysts in scaling the SRGCS sector. There are challenge funds which promote generation-based incentives and interest subsidies aimed at scaling SRGCS. But none of these programmes aim to work with the NEA.

Without the NEA on board, SRGCS with net metering cannot scale. Solar-based programmes are still designed to cater to the off-grid mode of solar. Subsidies and donor-driven programmes have in some extent helped scale micro-grid and solar home systems across Nepal, how effectively is part of another discussion. But SRGCS with net metering is different. It requires a huge role to be played by utility. Therefore, NEA focused programmes are important to scale SRGCS.

Net metering terminated

In July 2022, the NEA halted net metering altogether without any public notice. It has been five months, but there are no answers from the NEA. Top level NEA officials have told enquirers that the net metering matter has been presented to its board, and they are waiting for its endorsement. Rumours suggest that resentment towards solar is the primary reason. Whatever the reason, solar developers who installed SRGCS at industries are facing a financial catastrophe.

Customers are not paying for the installed SRGCS since it cannot be interconnected to the grid due to the sudden discontinuation of the net metering policy by the NEA. Solar developers, who have taken out loans from banks to implement these projects, are on the verge of collapse. A policy which was passed by the cabinet has been abruptly discontinued. Solar developers and consumers are bearing the brunt of this unprecedented step by the NEA. Due to the uncertainty in the net metering policy, attracting foreign direct investment or any other commercial funds to the sector has become challenging. Private equity partners who have invested in SRGCS-focused solar companies are raising questions. It will be hard to convince potential investors of the reliability of the net metering policy, thus hindering major FDI inflow to the sector.

Conversation

- Info. Dept. Reg. No. : 254/073/74

- Telephone : +977-1-5321303

- Email : [email protected]