Energy Update

Implementing Open Access in Transmission Services: A Nepalese Perspective

1. Introduction

An electric supply system is characterized by the three basic functions--generation, transmission, and distribution. Traditionally, these functions were delivered by a single regulated entity, which is featured as the vertically integrated utility (VIU). Gradually, liberalization was introduced into the electricity industry, similar to the other industry, leading to competition in the sector, especially in the generation, via independent power producers (IPPs). Likewise, transmission and distribution have evolved into natural monopoly utilities that facilitate competition among the generators and the consumers. In this context, it is practically infeasible for electricity generators and consumers to have their own transmission and distribution lines. They have to rely on the state's own transmission and distribution networks for the unrestricted power delivery.

The transmission system thus becomes the focus of attention in providing competition and must act as a `level playing field', through an open access in transmission service.

Open access (OA) is the practice of providing unrestricted access in the electricity transmission and distribution system, which has been envisaged as a framework for encouraging competition in the electricity sector and for enabling consumers to choose their suppliers. In open access, the licensee or user can utilize the transmission network by paying the transmission and other associated charges decided by the regulator. Regardless of location of buyer and seller, open access allows buying and selling of electricity utilizing the existing network and provides options for consumers to choose the electricity supplier. Such a setup will foster the economic operation of the wholesale electricity market, by exploring the favorable functions and market tools, which were otherwise restricted inherently in the VIUs.

2. Basis of OA

In a liberal electricity market, operation of Open Access relies on the five pillars, namely; (i) Institutional Setup, (ii) Legislative provisions, (iii) Regulatory guidelines, (iv) Open access pricing mechanism, (v) Operational Procedure. The functions of each unit are described as under.

• Institutional Setup: It relates to the establishment of the institutions for the market operation of the open access. Being the part of the liberalized market, the electricity power market demands formation of an unbundled power supply system. At minimal, there are generating companies or IPPs for the competitive power generation, trading companies for competitive supplies to the consumers; independent transmission and distribution companies to provide the competition, and an independent system operator to provide dispatch and ancillary services. All these entities should have autonomy in operation, without overlapping roles among them to minimize conflict of interest. This can be assumed as the hardware setup of the OA.

• Legislative Provisions: It includes the national law that allows and enforces the crucial functions, such as non-discriminatory open access in transmission and distribution, delicensing of generation, promoting Captive Generation, provision of bilateral and multilateral power exchange. These laws are like operating software to the hardware mentioned above.

• Regulatory Guidelines: This function is delivered by an independent regulator, which has power to develop technical standards (like Grid Code, connectivity standards), Commercial guidelines (like Transmission Tariff, available capacity etc), procedures for obtaining open access and activities that remove operational hurdles for the effective implementation of the OA services.

• Transmission Tariff: It is the cost involving the use of transmission services. It reflects the cost of the infrastructure and services of electricity wheeling. It is associated with different cost components, such as wheeling charge, reactive energy charge, congestion charge, dispatch charge, connection charge and other relevant surcharges. It is loaded by transmission system operators (TSO) themselves or separately by transmission utility and independent system operators, depending upon the nature of transmission system unbundling.

• Operation Guidelines: Once the four requisites are fulfilled, the process and procedure to implement open access is needed for the effective implementation of the OA services. It includes the formulation of activities; like mapping of open access process, procedure for applying and awarding the open access, guideline for managing open access, relinquishment process and other necessary measures.

3. Nepalese Context: Need and Preparedness of OA

The energy sector in Nepal is evolving towards a surplus out of its hydropower resources and it needs proper planning and frameworks in place to acquire maximum benefit from the available resources. It can be achieved through increased domestic consumption and exporting excess energy to neighboring countries. At present, NEA, in addition to being the supplier of electricity, is also the owner, the operator and the trader of the electricity network. In this scenario, few fundamental steps are needed to be put forward to realize the OA

Being the single entity of power trading and having set the priority of supplying electricity to all domestic consumers as the ‘service’, NEA has limited scope in exploring the market. It includes motivating schemes to different users’ groups, exploring the suppressed power demand in the existing and incoming industries, among others. As a result, the government has been providing survey licenses to all applicants, but has restricted PPA to the feasible and the construction-ready projects. If OA service is adopted in Nepal, an eligible consumer can procure electricity from sources other than NEA, or the IPPs can sell their electricity other than NEA, by using integrated transmission network upon the payment of its wheeling charge.

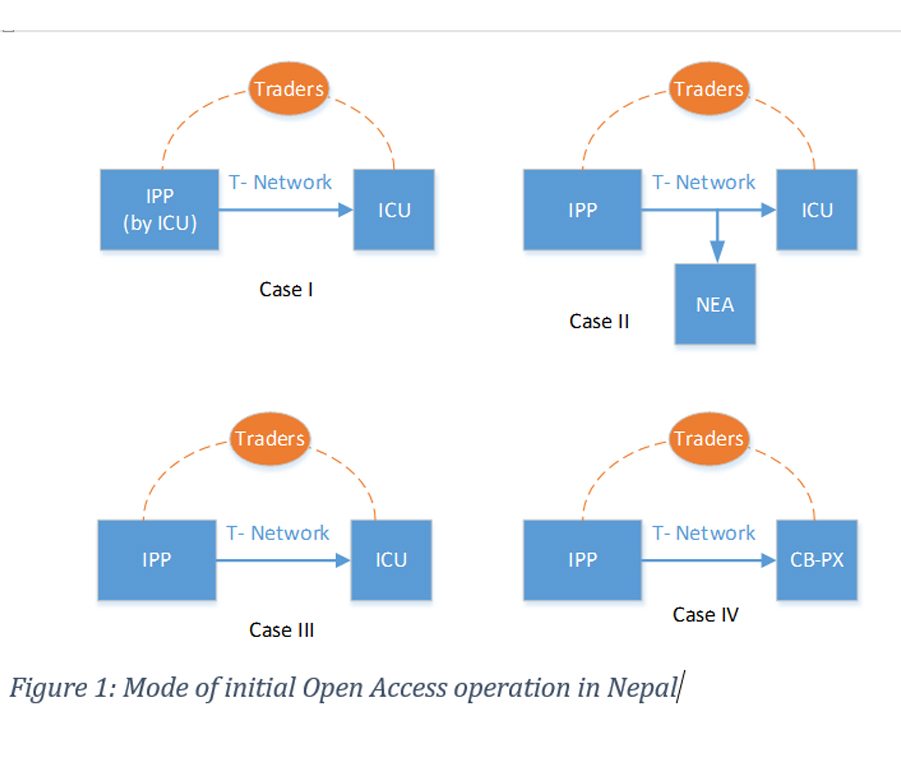

Upon facilitating the OA service in Nepal, large scale industrial and commercial users (ICU) and IPPs may engage in power trade activities in different ways:

• If there are IPPs that are owned by the ICU and want to use their own power, then they can do so by paying a suitable wheeling charge to the transmission owner and the operator (case I).

• The ICU and IPP may enter into long term PPA, through the OA transmission services of the transmission network (case III).

• The IPP can sell the surplus energy (that the NEA is not willing to buy) to the ICU, by using the OA transmission services of the transmission network (case II).

• The IPPs may enter into the long term PPA for the cross-border power exchange (CB-PX), to the ICU, by using the OA transmission services of the transmission network (case IV).

These modes of power exchange may be executed directly in bilateral mode, or through the traders, as desired and required by the market setup. These scenarios may also facilitate to explore the power market in a wider spectrum in domestic as well as the CB-PX. Furthermore, it will establish competition in the existing monopoly power market exercised by the NEA.

In order to discuss the preparedness of the OA transmission service in Nepal, we have to go through the basis of the OA framework, as described in section 2.

• Firstly, transmission services of the NEA should be unbundled, or at minimum the accounting and functional unbundling should be there.it will provide the basis of evaluating current asset of the transmission network, then to decide the wheeling charge of the network. The load dispatch center should ensure unbiased dispatched services to potential consumers and IPPs. Likewise, the suitable law should be enforced to allow bilateral and multilateral power trading, if necessary, by allowing the presence of multi traders for the PPA. For the full-fledged execution of OA, ownership unbundling is expected that will further leverage the multilateral power pool market for short-term, mid-term and long-term power trading through bidding.

• Secondly, we need to go through the prevailing laws and the policies. Hydropower Policy 2002 was the pioneer for power sector reform, with provisions for the establishing separate generation, transmission and distribution entities by unbundling the NEA (clause 6.15.2). The restructuring of the existing power sector to create a competitive environment by encouraging the involvement of community/cooperative institutions, local bodies and private sector, are formally incorporated in the text (clause 5.17).

The policy, however, lacks the provisions of multi power traders, regulatory operation, open access and transmission pricing. In order to address the drawback, Electricity Bill 2021 has been submitted to parliament and is expected to be promulgated soon. The Bill has clearly mentioned the license of power trading and consumer services (clause 9), scope of operation (Clause 29), and cross border trade (clause 30). Further, the provision of OA in the transmission grid has been detailed in clause 23. Once it is promulgated by the parliament, there will be a concrete foundation for OA operations.

While Pursuant to ERC ACT, 2074, has identified the provision of bilateral PPA between consumers and IPPs (clause 11), duty of ERC to provide OA in the electricity system (Clause 14), there is no further reference and detailing of the OA in the subsequent document. Likewise, the Act has not mentioned the provisions regarding cross-subsidy and additional surcharges, which are needed in pricing the OA tariff.

• Next part is the administration of OA by the ERC. By preparing suitable guidelines, ERC is required to deliver the functions, such as directives for setting the wheeling charge, cross subsidy (if any) and surcharges; issuing administrating the Grid Code; designating the nodal agency; and guideline for independent system operation and monitoring the non-discriminatory access.

• Another aspect is the preparedness of the transmission owners to deliver the OA services. It is associated with developing the modality of transmission OA charge, including several components, such as wheeling charge, reactive power charge, congestion charge, dispatch service charge, connection charge and surcharges. Until formation of a single National TransCo, NEA and Rastriya Prasaran Grid Company (RPGC) should work in close coordination to realize it.

• Upon fulfilling the criteria mentioned above, the culminating functions would be to prepare the operational framework of the OA services. It includes all the procedural tidbits, documentation, application of OA services and awarding mechanisms, operational priorities, and templates of the OA agreements and so on.

4. Outlook and Way Forward

As in other developing countries, electricity has the overlapping identity between the ‘state service’ and the ‘commodity’. On one hand, it is necessary to provide electricity service to remote areas as the fundamental duty of the state; and on the other hand, the market should flourish through competition and openness to reap the full economic benefits. With the prospects of utilizing maximum electricity in the domestic market and exporting surplus electricity to neighboring countries, it is necessary to act proactively to prevailing situations, rather than drawn reactively by the compelling situations. In the context of depriving IPPs from the PPA by the state, it is necessary to provide them opportunity to explore the domestic and international market. For this, a reasonable level of open access to the transmission system is desired.

Open Access is a process and also a culminating function of overall power sector reform, starting with VIU at a primitive stage into an advance stage in a fully deregulated market. In this regard, open access can be practiced along with the evolution of the power market structure. The initiation of OA can be started from the minimal phase to facilitate bilateral energy trade of manageable quantum, between the eligible IPPs and the ICUs. For this, the immediate step to be taken for granting the bilateral trade license for the eligible power traders. This demands a suitable pricing mechanism for transmission services, which, in turn, requires unbundling of NEA transmission assets, at least at functional and accounting levels.

On the wider aspect, full ownership unbundling is to be gradually implemented and Go should interfere to form a national Transco, by merging the overlapping responsibility of RPGCL and NEA’s transmission system. Thus, the power sector reform and the OA scope would evolve side by side, as the demand of the national and international power market for the bi-lateral, trilateral and multilateral power trade.

Dr. Gyawali, CEO National Transmission Co Ltd; this article is taken from the Urja Khabar bi-annual Journal published on 22nd June, 2022

Conversation

- Info. Dept. Reg. No. : 254/073/74

- Telephone : +977-1-5321303

- Email : [email protected]