Energy Update

Promoting India-Nepal Power Trade

Demand for electricity in South Asia, particularly in the BBIN Countries (Bangladesh, Bhutan, India and Nepal) is growing rapidly and is estimated to increase three times in the next 15-20 years. Despite huge potential for power generation, the BBIN countries face power shortage as they are unable to meet energy needs from their own domestic resources - causing huge impact on their social, economic and commercial activities. In addition to this, ensuring energy security together with promotion of clean energy in the region - requires a well-defined integrated transmission line, increasing investment in Power Sector, promoting renewables exploitations and enhancing bilateral to multilateral power trading.

Renewable Energy Integration in South Asia is a new dimension of discussion for a comprehensive transmission planning and fast installation of transmission line. The Energy endowments differ among the South Asian countries, and therefore, they may benefit by strengthening the mechanism of energy trade through improved connectivity. As Bhutan and Nepal have Hydroelectricity, Bangladesh can provide Gas based thermal electricity and India can play a vital role by providing a strong network of transmission line. It could also enhance grid stability by using regional hydropower to balance the large increases in variable solar and wind generation. Greater cooperation between the countries in South Asia can help in dealing with the Regional Energy security. This requires that the Governments in the Region take an active role in developing strategic cooperation for optimum exploitation and sharing of energy resources.

Nepal has enormous potential for hydroelectricity. 90 per cent of people of Nepal have access to grid connected electricity, however the country is yet to accomplish in building a sustainable infrastructure to provide uninterrupted energy supply. The country aims for per capita energy consumption to be 1500 KW by year 2028 with the surplus hydropower distributed to neighbouring countries after meeting domestic demand. Thus, Nepal is an energy surplus country and can export the same to the countries in the region in a very near future. Due to the diversity of resources and demand profile with respect to the integration of BBIN and hence, the electricity trade is considered for larger co-operation.

Nepal Power Scenario: The country has a hydropower potential of 83,000 megawatts (MW) and commercially exploitable hydropower generation potential is of approximately 42,000 MW. Nepal is currently producing 2,205MW of electricity, of which 1,900MW is generated from hydropower projects. Nepal hydro installed capacity is expected to rich 5000 MW in next five years and 15000 MW in 10 years. Total energy consumption in FY 2020/21 was 7,319 GWh, a slight increase over the corresponding figure of 6,529 GWh in the FY 2019/20.

Nepal Hydro Power Scenario

| Hydro Projects | MW | No. of Projects |

| Installed Capacity | 1907 | 164 |

| Under Construction | 3506 | 138 |

| Ready for construction | 1851 | 99 |

| Under Study | 16574 | 208 |

| Dedicated export project | 1979 | 2 |

| Total | 25417 | 611 |

| Potential (Future) | 57000 |

Source: Data Provided by IPPAN, Kathmandu on 21 Oct 2021

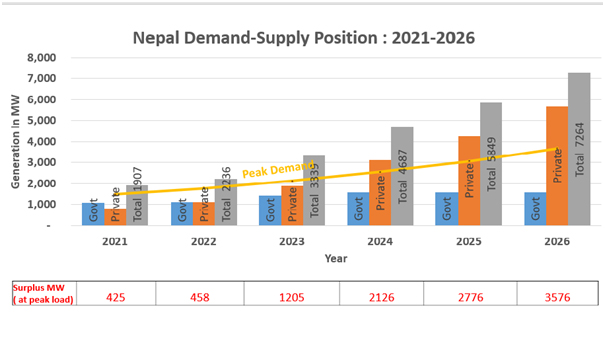

Forecast of Nepal’s Demand-Supply Position

Source: Data Provided by IPPAN, Kathmandu on 21 Oct 2021

Indo-Nepal Power Trade: Nepal is interconnected with India at various places through 11kV, 33kV, 132kV and 220kV lines. For transfer of bulk power, interconnection between India and Nepal through Dhalkebar (Nepal) - Muzaffarpur (India) 400kV D/C transmission line has been constructed. A total of about 700 MW of power is being supplied to Nepal through these interconnections. Further, 400kV D/C Gorakhpur (India) – Butwal (Nepal) line, 400kV D/C Dhalkebar (Nepal) – Sitamarhi (India) line, 132kV D/C Nanpara, Bihar (India) – Kohalpur (Nepal), stringing of second circuit of 132kV line Kataiya (India) – Kushaha (Nepal) and 132 kV Raxaul (India) – Parwanipur (Nepal) lines had been agreed.

The year 2018-2021 has witnessed a remarkable shift in power trading scenario. The Government of India has come out with the more flexible and business friendly cross border electricity trade guideline. It has also allowed the power trading in the Day Ahead market in some way. Virtually the New Guideline promotes free electricity trade in the region. The Second landmark decision was to consider Hydropower as renewable fully in India also. This central change in South Asia’s energy future has recast the spotlight on the ailing hydropower sector of the region, now reborn as a stabilizing factor against the inherent intermittency of solar and wind in the Indian grid. The vast untapped hydropower potential of Nepal and India could also sustain a portion of Bangladesh’s growing electricity demand and decrease the costs of universal electricity coverage in that country.

Indian developers’ perspective: Since, Nepal has a huge untapped Hydro Potential, and its regulation and tariff fixation policy is in the process of revising as more business friendly, so it provides an ample opportunity for Indian industry to invest in hydropower sector. However, there are some concerns of the Indian developers which should be taken care of:

1.Tariff: As per the hydro policy of Nepal, hydro power generators have to give a high percentage (around20-22%) free power. In addition to this a hydro power generator will pay royalty to the Govt. of Nepal after commencement of electricity generation. In Indian developers view it would bea costly if the power generated by Indian company in Nepal would export to India as it has to compete with the cost of power generated in India. It would be good if the tariff is relaxed to reduce the generated cost as it has to compete with the power generated in India in the open market.

2. Open Access: Nepal should create a symmetrical transmission by extending open access and aligning with the Indian Open Access. A Policy framework may be considered allowing open access to the transmission system in India for PPA based as also for merchant sale of power/power trading as applicable in India, to the project developers in Nepal.

3. Transmission / Evacuation: Evacuation of Electricity from Nepal to India has many problems. Nepal must have National Policy for Power Evacuation. While India follows pooling system for transmission of power, Nepal follows line by line arrangement. This creates tariff discrepancy.

4. Harmonization of regulation related to development of Power Generation Plant: The Government should take accelerated initiative to create harmonization with the specific laws for development of power generating plant. Also there should be a FastTrack mechanism to resolve the problem with PPA and project finance. The Government should make some business-friendly policy to tackle the socio-environment issues related to power plant generation. PDA should be made bankable. There should Government of Nepal guarantee on NEA obligation.

5. Promotion of Private Sector Participation: A very important source of funding in the region is funds flowing through increased private sector participation and public- private partnership. At present, most of the energy sector is operated by publicly owned utilities and these have not had good financial performance for a variety of reasons. As a result the investment capability of these utilities is limited.

Therefore, thrust has been given to encourage private sector participation in regional trade either individually or jointly with public utilities.

An advantage that private sector participation has is that these entities are seen as neutral parties driven by commercial principles as compared to state owned utilities. This adds to the credibility of their involvement in the cross border trade.

To conclude it can be said that reforms in power sector are very complex and phased implementation is required through vision & support in the form of effective Government Policies. There is an opportunity for Nepal to integrate power system with India and make use of robust nature of Indian power system. Deregulation of Electricity Supply Industry has succeeded where the market and Power Trading has been efficient and transparent. Participation in Indian Power Exchanges by Nepalese Merchant Power Plants & Discoms should be broaden at larger scale.

Nepal needs to build a robust transmission network for transmission of huge quantities of power across the border. Introduction of Open Access regime in Nepal and Power scheduling to Indian Power Grid should be encouraged widely. Energy Accounting & Settlement mechanism for Merchant Plant with Cross-border Power Sale to Indian Entities should be smoothen. Appropriate Tariff reflective of Cost of Service with adequate mechanisms for recovery of Fixed Cost & fuel cost recovery should be in place.

The Writer is a former Advisor, Ministry of External Affairs, Government of India; We have taken this article from Urja Khabar Semi-annual Journal Publish on 22nd June, 2022

Conversation

- Info. Dept. Reg. No. : 254/073/74

- Telephone : +977-1-5321303

- Email : [email protected]

.jpg)